| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

When a person invests in stock market, one of the most important questions is: What is the maximum amount that he can lose on his investment? Value at Risk (VaR) provides an answer to this, within a reasonable bound.

VaR calculates the worst expected loss over a given time horizon at a given confidence level under Normal Market Conditions. It can be measured at the portfolio, sector, asset class and

security level. VaR is particularly useful for investment banks, financial institutions and mutual fund investment managers.

VaR revolves around two main parameters- the time horizon and the confidence interval. The time horizon corresponds to the horizon for which we are calculating risk. If we are calculating daily VaR, we are estimating the worst expected loss that may occur by the end of the next trading day.Usually, VaR is calculated for a time horizon of one day or one month,that is, the maximum losses that an investorcan incur at the end can of one trading day

or one month (21 trading days). The confidence level is a reliability measure that expresses the accuracy of the result. A confidence level of 95% means that on 5 out of 100 trading days, the VaR would exceed the calculated maximum loss.

There are mainly three methods to calculate VaR- analytical, historical simulation and Monte-Carlo simulations. Analytical VaR is also called Parametric VaR since it assumes that returns are normally distributed.

Case Study 1 – Analytical VaR of a single asset

Suppose an investor invests Rs. 20 lakh in a single asset over a time horizon of 1 day and the VaR for this portfolio is found to be Rs. 1,72,400 at 99% confidence interval.

This means that there is a 1% chance that this asset may lose at least Rs. 1,72,400 at the end of the next trading day under normal market conditions.

Case Study 2 – Analytical VaR of a portfolio of two assets

Suppose another invests Rs. 1 crore in a portfolio diversified across two asset classes. The VaR at a 95% confidence level over a one-day horizon is calculated to be Rs. 4,98,900.

This means that there is a 5% chance that this asset may lose at least Rs. 4,98,900 at the end of the next trading day under normal market conditions.

Case Study 3 - VaR of a portfolio of five equally weighted schemes

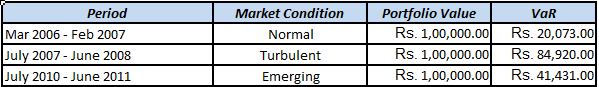

We considered a portfolio consisting five equally-weighted schemes which belonged to equity, debt, gilt, balanced and liquid funds respectively. We calculated VaR for three different periods – 2006-07, 2007-08 and 2010-11. The VaR for the portfolio is listed as follows:

*VaR calculated for 90% confidence interval