| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

When SEBI* mandated the provision of separate direct plans by AMCs for existing and new schemes in Sept’12, the news created a buzz in the financial markets. The idea was to have a separate plan for investments that wouldn’t be routed through distributors, have a lower expense ratio and have no commission. The plan would also have separate NAVs. The first direct plans were introduced in Jan’13 and today almost every scheme has a direct option.

We analyzed the performance of direct Vs regular funds to see how beneficial the lower costs are to the investor.

Direct Plans Vs Regular Plans

Regular plans are those that allow you to buy units of a scheme via a financial intermediary – a broker or a bank for instance. Due to the use of the intermediary, you need to pay fees to them. The AMC who’s schemes you purchased also need to pay a brokerage to the intermediary for the investment. Both the fees and the commission are a percent of the amount invested. Needless to say, these go to increase the expense ratio of the scheme and have a direct impact on the NAV of the scheme.

The direct plans instead allow you to purchase units of the scheme directly from the AMC (from their office or online). This results in lower expense ratio and as such higher NAVs resulting in higher returns for the investor in direct funds as against those in regular funds. Other than expense ratio there is no other difference between the two plans of a scheme.

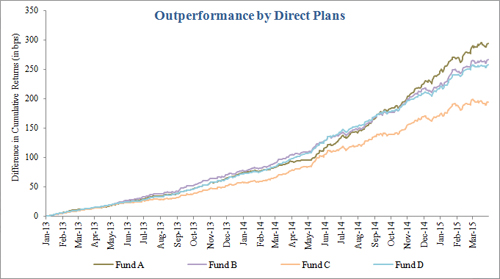

So how do direct funds generate higher returns for you? And do they do this consistently? We tracked 4 diversified schemes from Jan’13 to Mar’15 and compared the returns of direct and regular plans for each of the 4 schemes and found the results as per our expectation. When compounded, the difference in return between direct and regular funds increase substantially in the 27-month period to more than 150 basis points (equal to 1.5%)

Analysis of performance difference between Direct Plans and Regular Plans

We picked 4 equity diversified schemes from 4 different fund houses and analyzed their performance in direct and regular plans. Keeping the starting point as Jan’13, we tracked the incremental returns for each plan type for the 4 schemes. We then plotted the difference in returns (cumulative) between the two plan types from Jan’13 to Mar’15 and the results are shown in the graph below.

We used cumulative returns on a daily basis in order to arrive at the incremental benefit if the investor stays invested in a direct plan and then pegged it against the returns generated by the regular plans of the same funds. Further, using cumulative returns also reflects the effect of compounding with the passage of time.

Illustration I shows the outperformance of direct plan w.r.t a regular plan, i.e. the difference between the cumulative return of a direct plan and a regular plan, on a daily basis. The funds selected in the chart are popular diversified funds belonging to top-10 Mutual Fund houses. The analysis period starts from January 2013, exactly when the AMCs started declaring NAVs for direct plans.

Illustration I – Cumulative Returns - direct vs. regular plan of well known diversified funds

Source: MFI Explorer

Conclusion

- It makes ample sense to invest in funds via the direct route. The plans outperform their regular counterparts by more than 150 basis points and in some cases may even beat the regular funds by 300 basis points

- Due to the power of compounding, the outperformance by direct plans will only grow for the investor who stays invested for longer duration in the markets

- While the four funds chosen here were randomly picked, we haven’t run our tests on the entire universe of direct and regular funds available for investment. As such we are not in a position to comment if all direct funds outperform the regular funds and would advise investor caution in analyzing NAV of chosen schemes (for both direct and regular funds) prior to investing.

*Reference: http://www.sebi.gov.in/cms/sebi_data/attachdocs/1347547815927.pdf

To contact the author: amol.wakekar@icraonline.com