| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

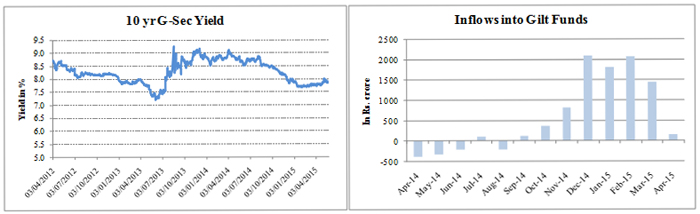

As inflationary expectations hit a twenty-one quarter low amidst a benign global environment, markets can anticipate early phases of a prolonged rate easing cycle, said SBI chairman, exuding optimism for the fixed income investors in a recent media interaction.

The pace of interest rate cuts has been on the rise: the Reserve Bank of India (RBI) has resorted to a repo rate cut on two occasions since Feb ’15. In Mar ’15, it lowered its benchmark repo rate by 50 basis points to 7.5% and during the current month of Jun ’2015, another 25 basis points were shaved off the repo rate.

The path of rate cuts hasn’t been an easy one. At its first monetary policy review of 2015 (on 2nd Feb), the central bank disappointed market participants by leaving the repo rate unchanged. As a result, the benchmark 10-year bond yield, which had declined in hopes of a rate cut, shot up from 7.65% to 7.73% within a day of the policy review.

Source: Reuters, AMFI website

The policymakers justified their cautious stance by saying they want to allow the disinflationary momentum to spread through the economy while waiting for commercial banks to cut lending rates. Further, they want to ensure that the economy dis-inflates gradually and durably, with CPI inflation targeted at 6% by Jan ’16 and at 4% by the end of 2017-18.

Gilt Funds during rate cycle change

Market participants are well aware of the fact that the central bank might undertake rate cut(s) in coming quarters as uncertainties surrounding inflation fade away. Gilt funds being sensitive to interest rates, witnessed a marked uptick in fund inflows during the 5 month period of Nov ’14 – Mar ’15.

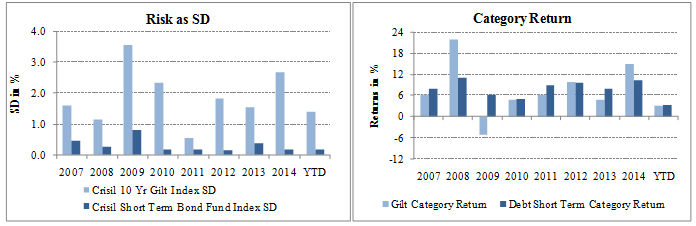

Gilt funds have given impressive returns off late, the category* posted returns close to 15% during the calendar year 2015, second highest returns since 2008. Since gilt funds invest only in government bonds, investors are protected from credit risk. However, there are other types of risk which exist. Like any other bond funds, these funds too have interest rate risk ingrained in them and are quite sensitive to interest rate movements.

Investors, who have been impressed with the returns offered by Gilt funds, also need to look at the risk-adjusted performance of these funds. There are other type of debt funds, which offer a better risk-return trade-off, and well, have a better record of consistency in delivering returns. For comparison sake, we can consider debt funds with short term maturity profile vis-à-vis gilt funds.

Looking at the recent past, gilt fund category returns are not as stable as compared to debt short term funds. The chart mentioned below gives a clear understanding of the risk-return trade-off investors can expect from gilt fund category when pegged against debt short term funds**. The Gilt market offers minimal credit risk and liquidity risk as trade volumes are significant here, unlike those in corporate bonds. Consequently, volatility tends to be higher in the Gilt market.

Higher risk (in terms of standard deviation) doesn’t necessarily convert into higher returns for gilt fund category as evident from the negative category returns of calendar year 2009. On the other hand, debt short term funds have given consistent returns with significantly lower risk over the years.

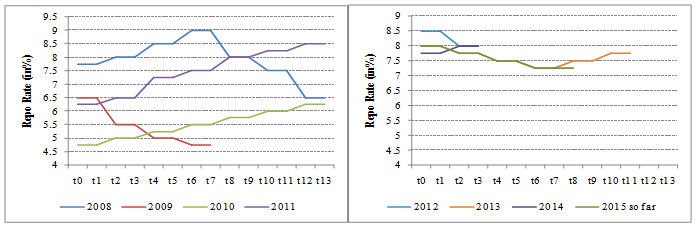

Source: MFI Explorer, RBI website

Correlation between the repo rate change cycle and gilt fund performance is hardly conclusive. The above mentioned charts depict central bank’s consecutive rate hikes/cuts during a particular calendar year. Apart from CY 2008 and 2009 period, where the gilt fund category exhibited increased volatility in returns both during the fall and rise of repo rates, other rate cycles fail to explain the category behavior. Rate cut cycles of CY 2012 and 2013 didn’t translate into healthy returns as concerns related to fiscal deficit and ability of the Government to pay its loans weighed on investor sentiment. Furthermore, when Government starts borrowing excessively, there emerges a situation of oversupply of G-secs. And when this oversupply appears at a time when foreign investors are risk averse, the market for Gilts turns less rewarding.

Therefore, investors enthused with prevailing rate cut expectations and gilt fund’s CY 2014 performance should consider the risk associated with this category before investing.

To contact author: amol.wakekar@icraonline.com

*comprising of 65 funds as per MFI Explorer; ** comprising of 52 funds as per MFI Explorer