| Top 5 Views |

| Minimum Alternate Tax and its recent impact o... |

| Popular and Unique Stocks |

| Start early to meet your financial goals |

| Decoding the concept: Value at Risk |

| Direct Plans – An Overview |

A fund manager while allocating funds to stocks of various companies (and possible in some debt instrument), leaves aside a small amount as cash or invests in liquid funds which can be converted to cash on short notice. This cash is usually allocated for planned and unplanned redemptions. However some financial market experts believe that fund managers, when they want to lower their exposure in stock markets, prefer to increase this cash allocation. This preference stems from their sentiment around markets at that point of time. Now allocations can change on a daily basis. However it is pertinent to see this cash percent on a monthly basis since sentiments are not expected to change daily.

In case when the fund manager’s sentiment on the market is not positive or the current trend cannot be reasonably interpreted, the fund manager will reduce the fund’s allocation to stocks and increase it in cash. The benefit of this simple strategy is when the movements in the stock market becomes clear or sentiment turns positive, the fund manager has the cash in hand to quickly invest additional funds in the stock market. Also, by reducing the stock exposure earlier, the fund manager pre-empts potential losses.

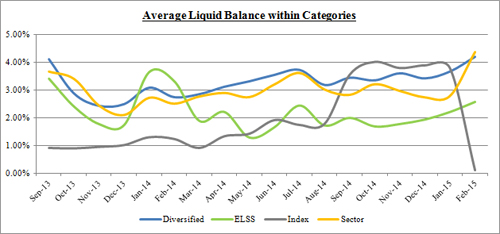

We look at four categories of equity mutual funds - Diversified, ELSS, Index and Sector to assess if any clear trend emerges from the cash allocation percentages. We looked at the categories as a whole and tracked their allocation to cash for a period of 18 months – Sept’13 to Feb’15. The graph below shows the trends

Source: MFI Explorer

A few key points emerge:

- Overall monthly trend seems similar for all four categories across 18 months though the quantum of change differs

- While the cash allocations reduced from Sept’13 for about 4 months, thereafter, the trend we see is an upward moving curve, except for Index funds. While the change (increase) in allocation to cash is not substantial, we would watch this metric closely in the coming few months to assess the sentiments

- Diversified and Sector funds seem to follow a close patterns mirroring the movements

- ELSS sees a downward trend from Feb to May which may explain the redemption cycle (that coincides with the 3 year purchase cycle)

- We find a huge increase in allocation to cash in Index funds from Aug’14 till Jan’15 before a sudden dive of less than 0.5% in Feb’15

To contact the author: poulomi.harolikar@icraonline.com